south dakota excise tax license

South Dakota Department of Revenue Sioux Falls Area Office. For all general contracting companies operating in South Dakota you will have to obtain a business and occupational license and register for tax identification numbers.

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

This does not mean that the contractors excise tax license itself must be displayed.

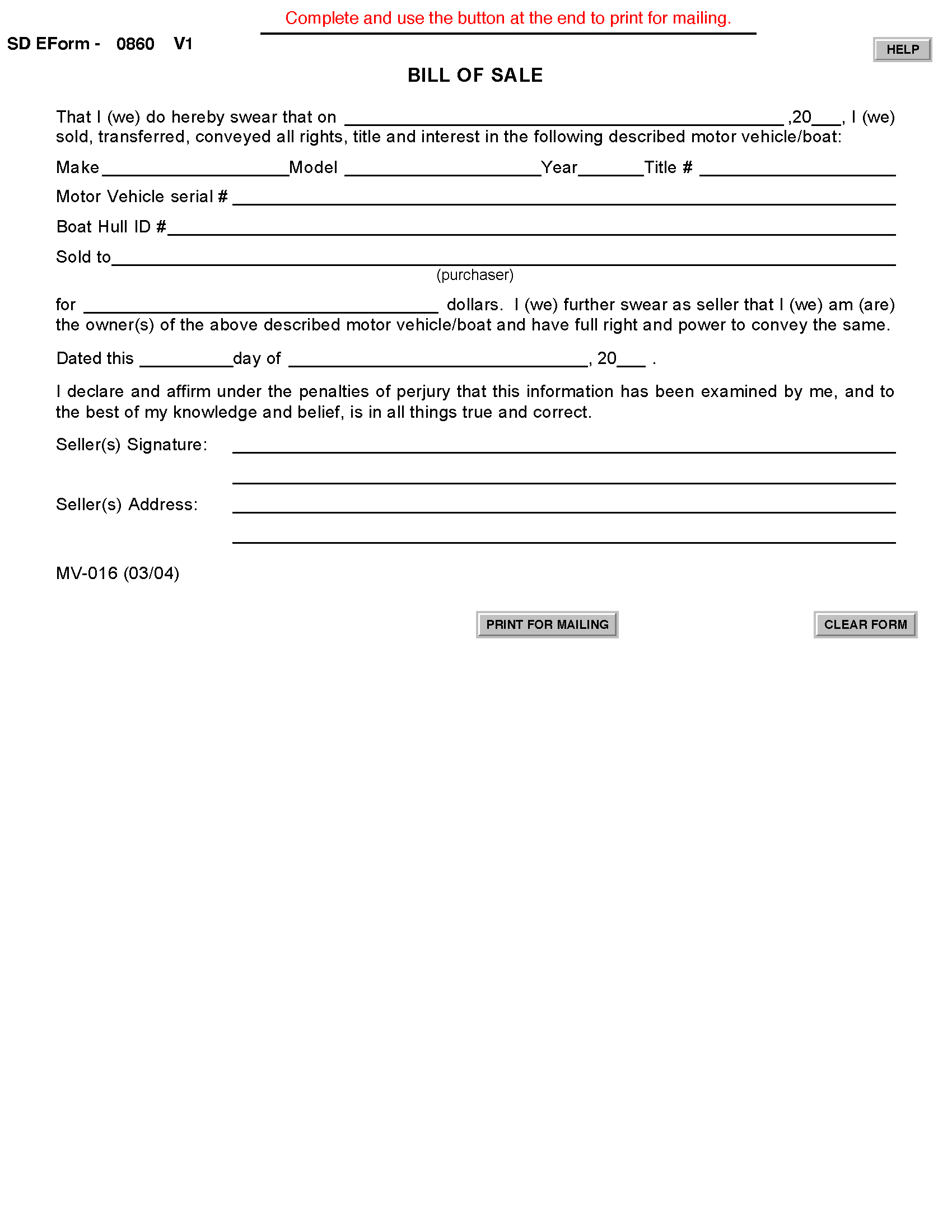

. This does not mean that the contractors excise tax license itself must be displayed. CONTRACTORS EXCISE TAX RETURN License. Total consideration does not include title fees registration fees vehicle excise tax paid pursuant to 32-5B-1 32-5B-11 and 32-5B.

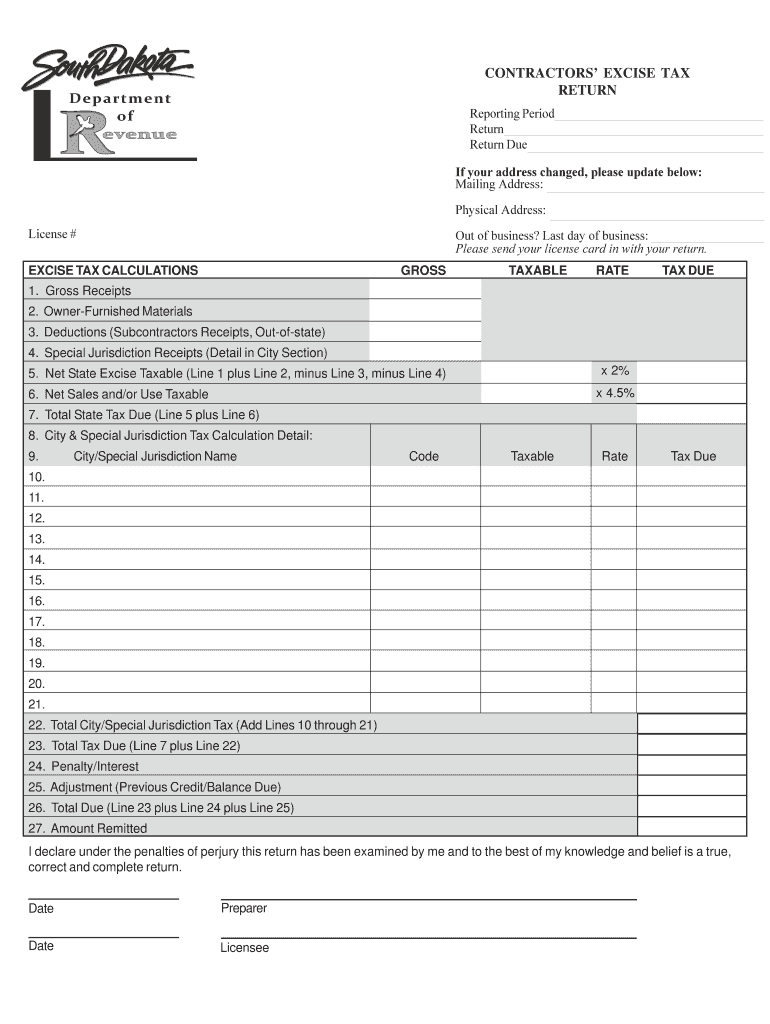

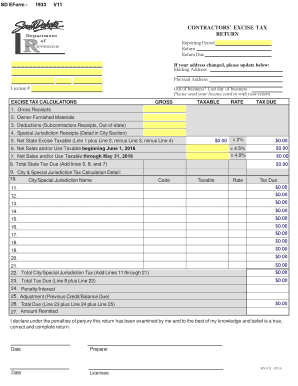

Excise taxesreplace standard sales taxes. Contractors Excise Tax Guide Laws Relating to Contractors Excise Tax Chapter 10-46A Projects Not Qualified Utility Projects Chapter 10-46B Qualified Utility Projects Chapter 10. Please use the box provided on the return to correct.

How to Apply for a South Dakota Tax License There is no fee for a sales or contractors excise tax license. Contractors excise tax license ET. South Dakota doesnt require many contractors to carry a contracting license but its serious about its tax excise requirements.

All contractors must display their contractors excise tax license numbers with their building permits. You will not be prompted to create an account and will not have access to the form after exiting the system. The price youll pay for your 25000 South Dakota Contractors Excise Tax License Bond is generally based on your personal credit score.

A contractors excise tax license is required if your business is entering into a realty improvement contract or a contract for construction services. If you dont have an EPath account and need to make a payment by ACH Debit or Credit. All the documents you need to register fast.

All contractors must display their contractors excise tax license numbers with their building permits. Furthermore it is applied against the car or trucks MSRP. Total Tax Due Total tax due is calculated by adding Lines 7 and 22 PenaltyInterest Interest125 0125 of the tax liability each month or part thereof for a return filed or any tax.

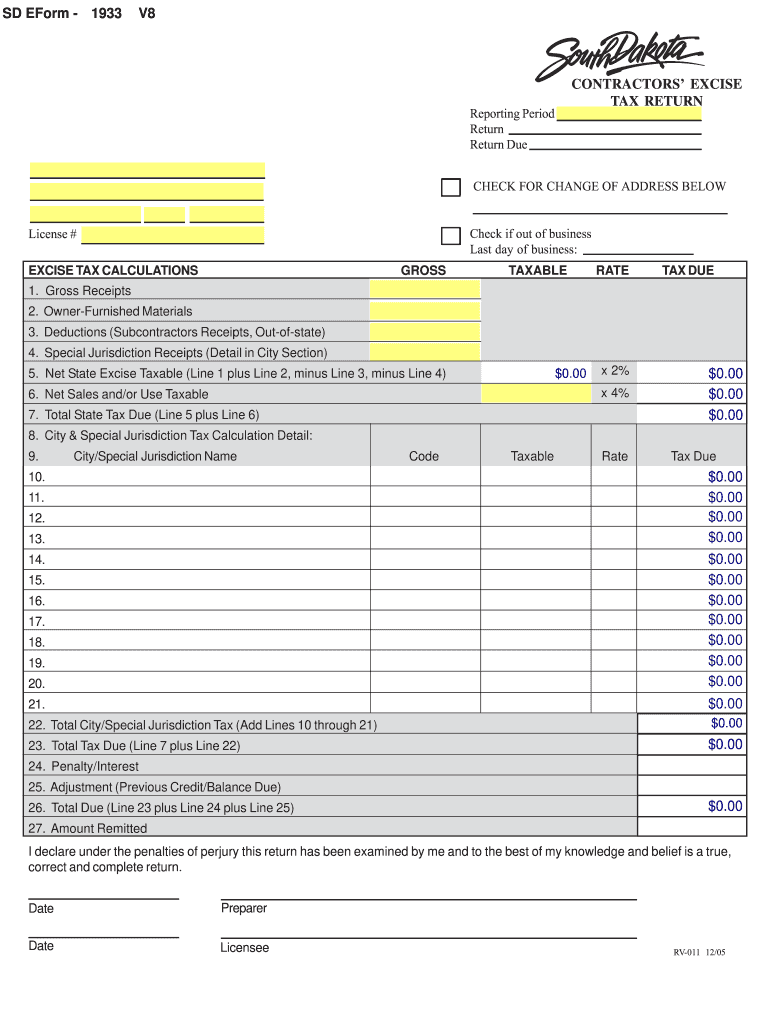

EXCISE TAX CALCULATIONS GROSS TAXABLE RATE TAX DUE x 2 x 4 Date Date Preparer Licensee Change of Address. TAX LICENSE APPLICATIONS This application allows for the renewal of the. Sycamore Ave Suite 102.

Start a free online quote by just completing a. Contractors who dont carry the appropriate tax. Sales and excise taxes are two separate taxes that many people pay attention to because they directly affect the price of.

Business Tax Division 300 S. South Dakota law also requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one. Sign up to file and pay.

South Dakota Codified Laws 32-5B-21 32-5B-21. All brand-new vehicles are charged a 4 excise tax in the state of South Dakota. Create an Account If you are not already using EPath to access your account create an account now.

A license card will be issued once the license is approved.

South Dakota Sales Tax Information Sales Tax Rates And Deadlines

Free South Dakota Tax Power Of Attorney Form Rv 071 Pdf Eforms

South Dakota Income Tax Tax Benefits South Dakota Dakotapost

Sue Me South Dakota Taxes Attorney Services Avalara

Helpful Sd Fuel Tax Links Mflc

Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd Fill And Sign Printable Template Online Us Legal Forms

Taxes South Dakota Department Of Revenue

North Dakota Cigarette And Tobacco Taxes For 2022

Contractors Excise Tax Webinar Youtube

South Dakota Taxes Sd State Income Tax Calculator Community Tax

Free South Dakota Boat Bill Of Sale Form Pdf Word

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online Us Legal Forms

Taxes South Dakota Department Of Revenue

Free South Dakota Tax Power Of Attorney Form Rv 071 Pdf Eforms

Sd Excise Tax Form Fill Online Printable Fillable Blank Pdffiller

Nssf The Firearm Industry Trade Association On Twitter South Dakota S Govkristinoem R Has Proclaimed August 2020 As National Shooting Sports Month Acknowledging The Firearm Industry S 346 Million Economic Impact In The State And

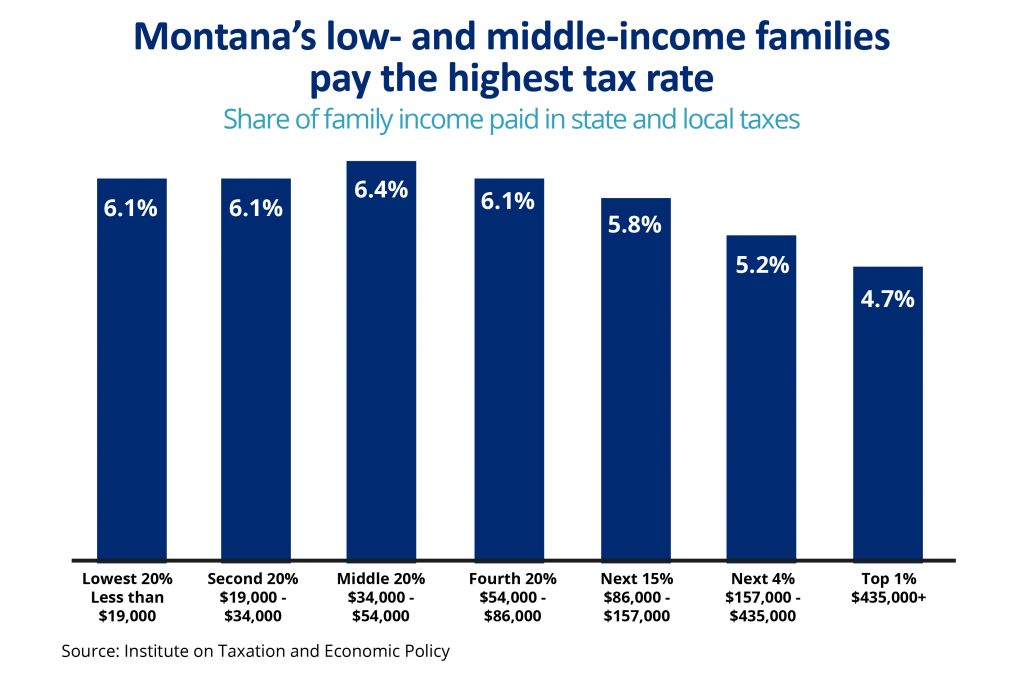

Problems With A Statewide Sales Tax Montana Needs To Help Not Hurt Families Montana Budget Policy Center

Economic Nexus Hawaii General Excise Tax And Providing Services In Hawaii Tax Solutions Lawyer